Showing 1-12 of 16 results

Series

Global Health Symposium

Strengthening Global Health Governance: Defending the Public Interest and Holding Powerful Private Actors Accountable

Press Release

The Fiscal Architecture of Health: UNU-IIGH Policy Brief Calls for Global Tax Reform as a Public Health Imperative

Tax reform is not a peripheral financial and economic issue, but a core mechanism for achieving global health equity and accountable governance.

Announcement

Enrol Now: SOUTHMOD Online Training Course

This online introductory course is designed to equip students with foundational skills in tax benefit microsimulation models.

Conference

Revving Up Revenue for Development – The Role of Domestic Resource Mobilization

OSLO: The WIDER Development Conference on the role of domestic revenue mobilization in development takes place in during 6-8 September, 2023.

Training

Second UGAMOD Retreat

KAMPALA: UNU-WIDER will host a training event on UGAMOD, the tax-benefit microsimulation model for Uganda, as a five-day research retreat.

Conference

SOUTHMOD presentation at the LOTTE-Skatt conference

OSLO: UNU-WIDER Research Associate Jesse Lastunen will give a presentation at the conference, Celebrating tax-benefit modeling: 50 years with LOTTE.

Event

How Can Tax-benefit Systems Support Households Through Crisis?

On 13 December 2022, UNU-WIDER will host a webinar, 'How Can Tax-benefit Systems Support Households Through Crisis?'

Seminar

Tax Effort Revisited: How Much Tax Can Low-income Countries Expect to Collect?

This will be the first event in the new Think WIDER Webinar Series — New Perspectives on Domestic Revenue Mobilization.

Event

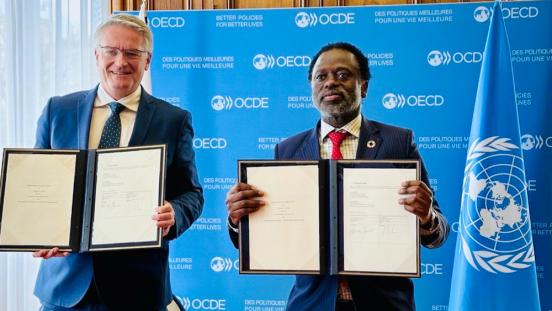

Developing Fiscal States in Africa

On 2 December 2021 UNU-WIDER and the OECD Development Centre will host an online panel discussion on Developing Fiscal States in Africa.